If you’re new to the world of online trading, you may have come across the name Quotex. This broker has been gaining popularity in recent years, offering traders a wide range of assets and a user-friendly trading platform. But with so many brokers out there, it’s important to do your research before choosing one to invest your hard-earned money with.

In this Quotex review, we’ll take an in-depth look at this broker and determine if it’s a legitimate and trustworthy option for traders. Naototnhat cover everything from its regulation and licensing details to its trading platform, deposit and withdrawal methods, and more. So let’s dive in and find out if Quotex is the right broker for you.

What is Quotex Broker?

Quotex is an online trading platform that allows users to trade a variety of assets, including currencies, commodities, stocks, and indices. It was founded in 2016 and is owned by Awesomo Ltd., a company based in St. Vincent and the Grenadines. The broker operates globally, with a strong presence in Europe, Asia, and Africa.

One of the main selling points of Quotex is its web-based trading platform, which is designed to be user-friendly and accessible for both beginner and experienced traders. The platform offers a variety of tools and features to help traders make informed decisions, such as real-time charts, technical indicators, and market news updates.

Is Quotex Regulated in the US?

The short answer is no. Quotex is not regulated in the United States, nor does it accept clients from the US. This is because the broker is not registered with the US Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC), which are the two regulatory bodies responsible for overseeing the financial markets in the US.

However, Quotex is regulated by the International Financial Market Relations Regulation Center (IFMRRC), which is a non-governmental organization that provides certification and regulation for brokers operating in the financial markets. While this may not be as strict as being regulated by a government agency, it does provide some level of oversight for the broker’s operations.

Quotex Review: Scam or Legit?

Now, let’s address the elephant in the room – is Quotex a scam? With so many online brokers out there, it’s natural to be skeptical and wonder if a particular broker is legitimate or not. In the case of Quotex, there have been some concerns raised by traders about its legitimacy, but there is no concrete evidence to suggest that it is a scam.

One of the main reasons for these concerns is the fact that Quotex is not regulated by any major regulatory body. However, as mentioned earlier, it is still regulated by the IFMRRC, which provides some level of protection for traders. Additionally, the broker has been in operation since 2016 and has built a solid reputation among its clients.

Regulation and Licensing Details

As mentioned earlier, Quotex is regulated by the IFMRRC, which is a non-governmental organization based in Russia. The organization was established in 2010 and aims to provide certification and regulation for brokers operating in the financial markets. It also offers dispute resolution services for traders who have issues with their brokers.

While the IFMRRC may not be as well-known or respected as other regulatory bodies, it does provide some level of oversight for Quotex’s operations. The broker also holds a certificate from the Financial Commission (FinaCom), which is an independent external dispute resolution organization. This further adds to the broker’s credibility and trustworthiness.

QUOTEX Pros

- User-friendly trading platform

- Wide range of assets to trade

- Low minimum deposit requirement

- Fast and easy account registration process

- Multiple deposit and withdrawal methods

- Mobile trading app available

- 24/7 customer support

QUOTEX Cons

- Not regulated by major regulatory bodies

- Limited educational resources for traders

- No demo account option

- Limited information on company background and ownership

- Does not accept clients from the US

Is QUOTEX Legit?

Based on our research, we can say that Quotex is a legitimate broker. While it may not be regulated by major regulatory bodies, it is still regulated by the IFMRRC and holds a certificate from FinaCom. The broker has been in operation for several years and has built a solid reputation among its clients. However, as with any online broker, there are risks involved in trading, so it’s important to do your own due diligence and only invest what you can afford to lose.

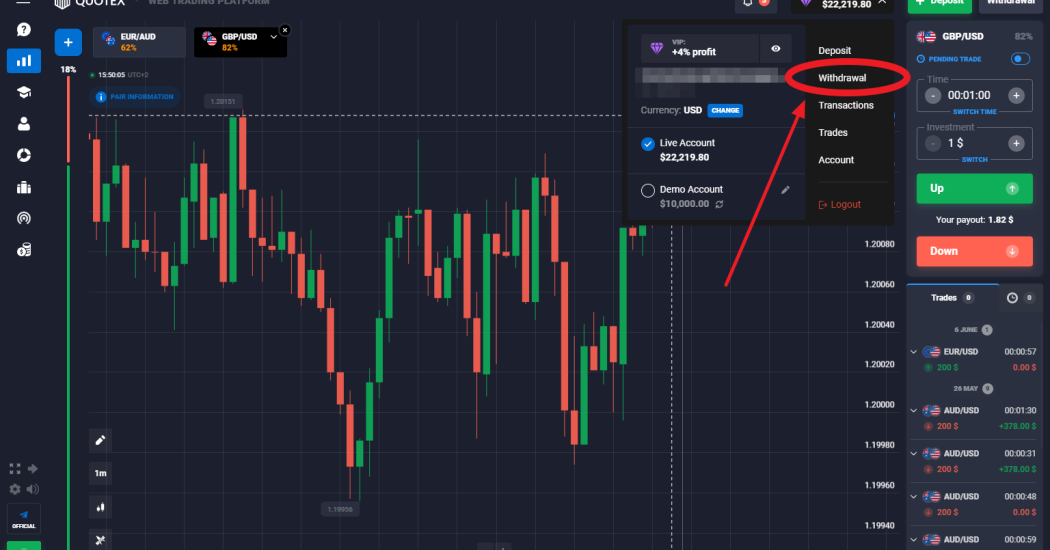

Quotex Web Trading Platform

One of the main highlights of Quotex is its web-based trading platform. It is designed to be user-friendly and accessible for traders of all levels of experience. The platform offers a variety of tools and features to help traders make informed decisions, such as real-time charts, technical indicators, and market news updates.

The platform is also highly customizable, allowing traders to adjust the layout and settings according to their preferences. It is also available in multiple languages, making it accessible to traders from different parts of the world. Additionally, Quotex offers a mobile trading app for both iOS and Android devices, allowing traders to access their accounts and trade on-the-go.

Key Features of Quotex Web Trading Platform

Real-Time Charts

Quotex offers real-time charts for all assets, allowing traders to monitor price movements and identify trends. The charts can be customized with various time frames and technical indicators to help traders make informed decisions.

Technical Indicators

The platform offers a variety of technical indicators, such as moving averages, Bollinger Bands, and MACD, to help traders analyze market trends and identify potential entry and exit points.

Market News Updates

Quotex provides regular market news updates to keep traders informed about the latest events and developments that may affect their trades. This can be a valuable tool for making informed trading decisions.

Assets Trade With Quotex Broker

Quotex offers a wide range of assets for traders to trade, including:

- Currencies: Major, minor, and exotic currency pairs

- Commodities: Gold, silver, oil, and other precious metals and energy resources

- Stocks: Shares of major companies from around the world

- Indices: Major stock market indices, such as S&P 500, NASDAQ, and FTSE 100

With such a diverse range of assets, traders have the opportunity to diversify their portfolios and potentially profit from different markets.

Quotex Deposit and Withdrawal Methods

Quotex offers a variety of deposit and withdrawal methods to cater to the needs of its clients. These include:

- Credit/debit cards: Visa, Mastercard, Maestro

- E-wallets: Skrill, Neteller, Perfect Money, WebMoney

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin, Ripple

- Bank wire transfer

The minimum deposit amount for all methods is $10, which is relatively low compared to other brokers in the industry. The processing time for deposits is instant, while withdrawals may take up to 3 business days to process.

Quotex Real or Fake?

As with any online broker, there have been some concerns raised by traders about the legitimacy of Quotex. However, based on our research and analysis, we can say that Quotex is a legitimate broker. It may not be regulated by major regulatory bodies, but it is still regulated by the IFMRRC and holds a certificate from FinaCom.

Additionally, the broker has been in operation for several years and has built a solid reputation among its clients. However, as with any online broker, there are risks involved in trading, so it’s important to do your own due diligence and only invest what you can afford to lose.

Is Quotex Safe?

The safety of traders’ funds and personal information is a top priority for any reputable broker. In the case of Quotex, the broker takes several measures to ensure the safety and security of its clients, such as:

- SSL encryption: The broker’s website is secured with SSL encryption, which protects users’ personal and financial information from hackers.

- Segregated accounts: Client funds are kept in separate accounts from the broker’s operational funds, ensuring that they are not used for any other purposes.

- KYC and AML procedures: Quotex follows strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to prevent fraud and money laundering activities.

Does Quotex Pay Out?

One of the main concerns raised by traders about Quotex is whether the broker pays out profits to its clients. Based on our research, we can say that Quotex does pay out profits to its clients. However, there have been some complaints from traders about delays in withdrawals and difficulty in contacting customer support. This could be due to the high volume of transactions on the platform, but it’s something to keep in mind when choosing this broker.

What is the Minimum Deposit for Quotex Trading?

As mentioned earlier, the minimum deposit amount for Quotex is $10, which is relatively low compared to other brokers in the industry. This makes it accessible for traders with different budgets to start trading with this broker. However, it’s important to note that the minimum deposit amount may vary depending on the deposit method chosen.

In conclusion, Quotex is a legitimate broker that offers a user-friendly trading platform and a wide range of assets for traders to trade. While it may not be regulated by major regulatory bodies, it is still regulated by the IFMRRC and holds a certificate from FinaCom. The broker also takes measures to ensure the safety and security of its clients’ funds and personal information.

However, as with any online broker, there are risks involved in trading, so it’s important to do your own due diligence and only invest what you can afford to lose. Additionally, there have been some concerns raised by traders about delays in withdrawals and difficulty in contacting customer support. So if you decide to trade with Quotex, make sure to keep these factors in mind and proceed with caution.